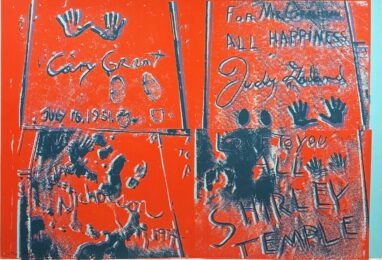

Money Matters: Andy Warhol (1928-1987)

The Warhol market is popular culture incarnate as it bestrides both high art and commercial goods. His Factory art production, driven simultaneously by celebrity profligacy and commercial banality, epitomized late 20th century popular culture and furthermore advertised it as art. His art however is indivisible of his artist persona, befalling a brilliant marketing scheme to brand all that is Warhol.

It follows then that purchasing a Warhol work is buying into Warhol himself, blonde wig and all. Today the Warhol brand is as instantly recognisable as the familiar consumer products and superstar icons used as the subject matter of his art. The recognisability, in part due to his conscientious business sense and success at auction, is greater influenced by a co-branding strategy implemented by The Andy Warhol Foundation for the Visual Arts, which inversely uses the Warhol brand on consumer products like Campbell’s soup cans– creatively inspiring a re-branding of such products with a bit of the Warhol insignia. So while his works at auction fetch upwards of over $1million on average, one can buy a Warhol print, or even limited edition Warholian soup can, at a fraction of the cost.

It may appear that since there is a whole lot of Warhol out there, on both the commercial and art markets, the sheer volume alone would oversaturate and even devalue the works at the very high end. However, this is not the case. For in 2012, Warhol was both the top artist by auction revenue, whilst the Campbell’s Soup Company, in conjunction with the Warhol Foundation, released the limited edition Andy Warhol soup cans series in celebration of the 50th anniversary of his iconic 32 Campbell’s soup cans (1962). The Warhol market is thus an all encompassing market extending from the plutocratic high end to the more populist.

While the overall Warhol market, excluding price points of over $5million, peaked in 2007 the strength of his market was re-established in 2011. According to ArtTactic, it was in 2011 that he accounted for 27% of the market share, with $336.3 million in sales out of the approximately $1.26 billion contemporary art auction market –placing him third to China’s Qi Baishi and Zhang Daqian as the top best-selling artists worldwide. This signified an 8% increase from 2010, where he accounted for $277 million worth of sales. 2011 was a robust year as 148 paintings were up for auction. Four of which sold for over $20 million in the latter part of 2011.

However, early on in 2012, Gerhard Richter and Francis Bacon bested the high end of the Warhol market. This may be indicative of Warhol losing his dominant position in the post war and contemporary art market, however his market confidence remained high throughout 2012. While the first half of 2012 showed enormous earnings in terms of overall auction results, the latter part of 2012 was not as robust as the same period in 2011. This may in part be due to an announcement made by the Warhol Foundation, stating their intent to sell off their entire collection of works by the artist through Christie’s auction house in efforts to raise funds for its endowment. The collection included approximately 350 painting, and thousands of prints, drawings, and photographs, all of which had the benefit of being authenticated despite the dissolution of the foundation’s authentication board in early 2012 due to controversy and high litigation costs.

[Author: Nicole Crisonino, Sotheby’s Institute of Art]

View prints by Andy Warhol here.